Will prices in the Toronto real estate market continue to rise at what appears to be an unsustainable rate?

Should you buy now because over time real estate is more likely to rise than it is to fall? Or should you wait and see what happens over the next six months? These are difficult questions to answer. One thing is for certain though, the next six months are going to be very interesting.

It’s not surprising to see a unified voice from most news media reporting the same narrative of an overvalued market that is likely to crash. Is the media working with government (CMHC)to cool the market by instilling fear? Or is there genuine economic data to suggest a major correction is likely?

Regardless of the narrative, it would take a pretty big event for the Toronto real estate market to crash, ie. if the political system was suddenly overthrown, and property rights granted in a free market society where replaced with a communist system. Or if a significant event caused enough chaos to shut off financing and people could no longer borrow money.

Table of Contents

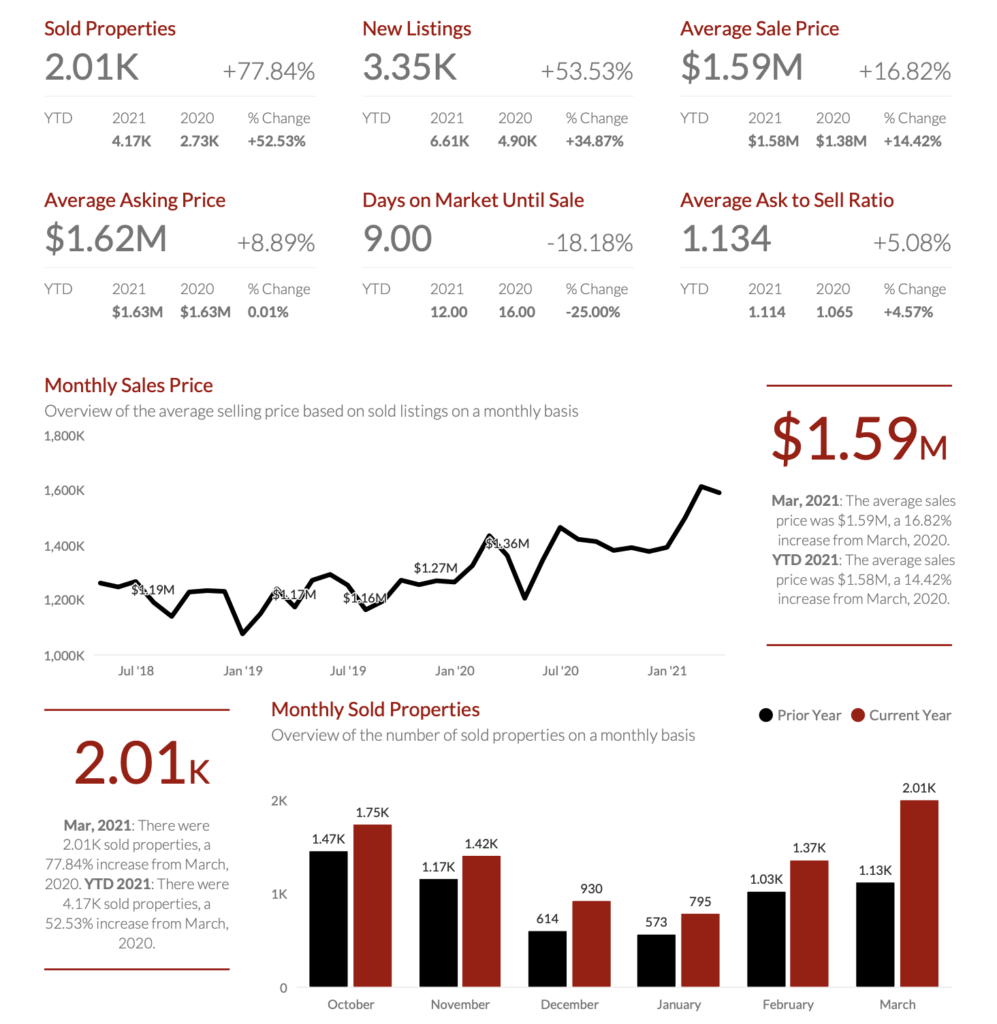

Toronto Freehold Market for March 2021

Low interest rates

Historically low interest rates are playing a part in the hot Toronto real estate market. But this is not the fundamental problem behind rising prices. Interest rates are likely to rise slightly but the Bank of Canada would likely prevent any drastic movement so it’s unlikely that moderate rate hikes will have much impact on prices because there’s such a shortage of inventory.

Low inventory

The long term supply issue is a much bigger problem. Low interest rates just amplify the fact that there’s not enough inventory.

International Buyers

Toronto has become a global destination, so if travel restrictions get lifted and immigration starts up again there will be a surge of international buyers from Hong Kong, Taiwan, Saudi Arabia, the United States, and elsewhere releasing a pent up demand for properties. which will add more pressure to the limited supply pushing the markets higher.

Sell then Rent Trend

I’ve heard many sellers are choosing to rent after cashing in at the top. Most sellers getting out of the market are opting to rent detached houses, while they wait and see what happens. This puts even more pressure on rental house prices.